~ THE FIVE GENERIC COMPETITIVE STRATEGIES ~

WHICH ONE TO EMPLOY ?

NUR FILZAH BINTI SULAIMAN

TMA 2

1110820

MGB4013 STRATEGIC MANAGEMENT

Why strategies differ ?

The key factors that distinguish one strategy from another :

- Is the firm's market target broad or narrow ? or

- Is the competitive advantage pursued linked to low costs or product differentiation ?

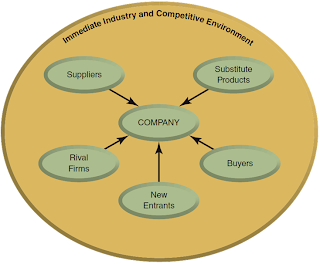

The Five (5) Generic Competitive Strategies.

- Low-Cost Provider : Striving to achieve lower overall costs than rivals on products that attract a broad spectrum of buyers. ( give a lower price to buyers )

- Broad Differentiation : Differentiating the firm's product offering from rivals' with attributes that appeal to a broad spectrum of buyers. ( the unit factors that different from other companies )

- Focused-Low Cost : Concentrating on a narrow price-sensitive buyer segment and on cost to offer a lower-priced product. ( focus more on target market )

- Focused Differentiation : Concentrating on a narrow buyer segment by meeting specific tastes and requirements of niche members.

- Best-Cost Provider : Giving customers more value for the money by offering upscale product attributes at a lower cost than rivals.

Figure 5.1 The Five Generic Competitive Strategies

Major avenues for achieving a cost advantage.

Low-cost advantage : A firm's cumulative costs across its overall value chain must be lower than competitors' cumulative costs.

How to gain a low-cost advantage :

- Perform value chain activities more cost-effectively than rivals.

- Revamp the firm's overall value chain to eliminate or bypass cost-producing activities.

Cost driver is a factor with a strong influence of a firm's costs. Its can be asset or activity-based.

Low-cost advantage : A firm's cumulative costs across its overall value chain must be lower than competitors' cumulative costs.

How to gain a low-cost advantage :

- Perform value chain activities more cost-effectively than rivals.

- Revamp the firm's overall value chain to eliminate or bypass cost-producing activities.

Cost driver is a factor with a strong influence of a firm's costs. Its can be asset or activity-based.

Figure 5.2 Cost Drivers : The Keys to Driving Down Company Costs

Core Concept :

- The essence of a broad differentiation strategy is to offer unique product attributes that a wide range of buyers find appealing and worth paying for.

- A uniqueness driver is a factor that can have a strong differentiating effect.

Figure 5.3 Uniqueness Drivers : The Keys to Creating a Differentiation Advantage.

Revamping the value chain system to increase differentiation.

- Approaches to enhancing differentiation through changes in the value chain system.

- Coordinating with channel allies to enhance customer perceptions of value.

- Coordinating with suppliers to better address customer needs.

When the differentiation strategy work best ?

Pitfalls to avoid in pursuing a differentiation strategy :

- Relying on product attributes easily copied by rivals.

- Introducing product attributes that do not evoke an enthusiastic buyer response.

- Eroding profitability by overspending on efforts to differentiate the firm's product offering.

- Offering only trivial improvements in quality, service or performance features deal than the product of rivals.

- Adding frills and features such that the product exceeds the needs and use patterns of most buyers.

- Charging too high a price premium.

Focused ( or market niche ) Strategies.

Focused strategy approaches :

- Focused low-cost strategy

- Focused low-cost strategy

- Focused market niche strategy

Core Concept : Best-cost provider strategies are hybrid of low-cost provider and differentiation strategies that aim at providing desired quality, features, performance, service attributes while beating rivals on price.